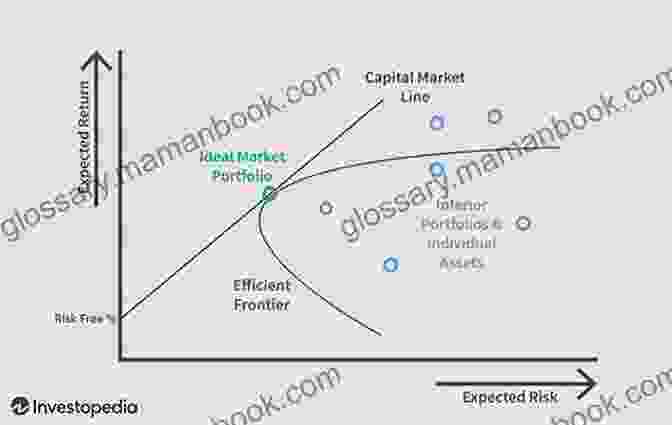

The Capital Asset Pricing Model (CAPM) is a fundamental concept in finance that provides a framework for understanding the relationship between risk and return. It is particularly relevant for MBA students and professionals who are seeking to optimize investment returns and enhance their financial management knowledge. By harnessing the power of beta, which is a measure of an asset's systematic risk, investors can leverage CAPM to make informed investment decisions and advance their MBA goals.

Beta: Understanding Systematic Risk

Beta measures the volatility of an asset relative to the overall market. A beta of 1 indicates that the asset's price moves in line with the market. A beta greater than 1 indicates that the asset is more volatile than the market, while a beta less than 1 indicates that the asset is less volatile. Systematic risk, also known as market risk, is the risk that affects all assets in the market and cannot be diversified away.

CAPM: Connecting Risk and Return

CAPM provides a formulaic approach to estimating the expected return on an asset based on its beta. According to CAPM, the expected return on an asset is equal to the risk-free rate plus a risk premium. The risk premium is determined by multiplying the asset's beta by the market risk premium, which is the difference between the expected return on the market portfolio and the risk-free rate.

The CAPM formula can be expressed as:

Expected Return = Risk-Free Rate + Beta * Market Risk Premium

By understanding beta and utilizing CAPM, investors can assess the risk and potential return of an asset and make informed investment decisions.

Leveraging Beta and CAPM for MBA Advancement

The application of beta and CAPM is invaluable for MBA students and professionals seeking to advance their careers in finance and investment management. Here are some key ways in which beta and CAPM can empower MBA journey:

- Risk Assessment: Beta provides a quantitative measure of an asset's risk relative to the market. Understanding beta allows investors to assess the potential volatility of an asset and make informed decisions about their investment portfolio.

- Investment Selection: By utilizing CAPM, investors can determine the expected return on an asset based on its risk. This information enables them to select investments that align with their risk tolerance and financial goals.

- Portfolio Optimization: Beta can be used to create a diversified portfolio that minimizes overall risk while maximizing potential return. By combining assets with different betas, investors can reduce the overall volatility of their portfolio.

- Financial Modeling: Beta and CAPM are essential concepts used in financial modeling. Understanding these concepts allows MBA students and professionals to develop accurate and robust financial models for investment analysis.

- Career Advancement: Proficiency in beta and CAPM is highly valued in the financial industry. Demonstrating a strong understanding of these concepts can enhance the credibility and career prospects of MBA graduates.

Harnessing the power of beta and the Capital Asset Pricing Model is crucial for MBA students and professionals seeking to excel in finance and investment management. By understanding beta as a measure of systematic risk and applying CAPM to assess risk and return, investors can make informed investment decisions, optimize their portfolios, and advance their MBA goals. Embracing these concepts will empower MBA graduates to navigate the financial landscape with confidence and achieve their investment objectives effectively.